How to Use Machine Learning to Detect Credit Card Fraud

Financial firms stay one step ahead of fraudsters by analyzing customer behavioral patterns for abnormalities.

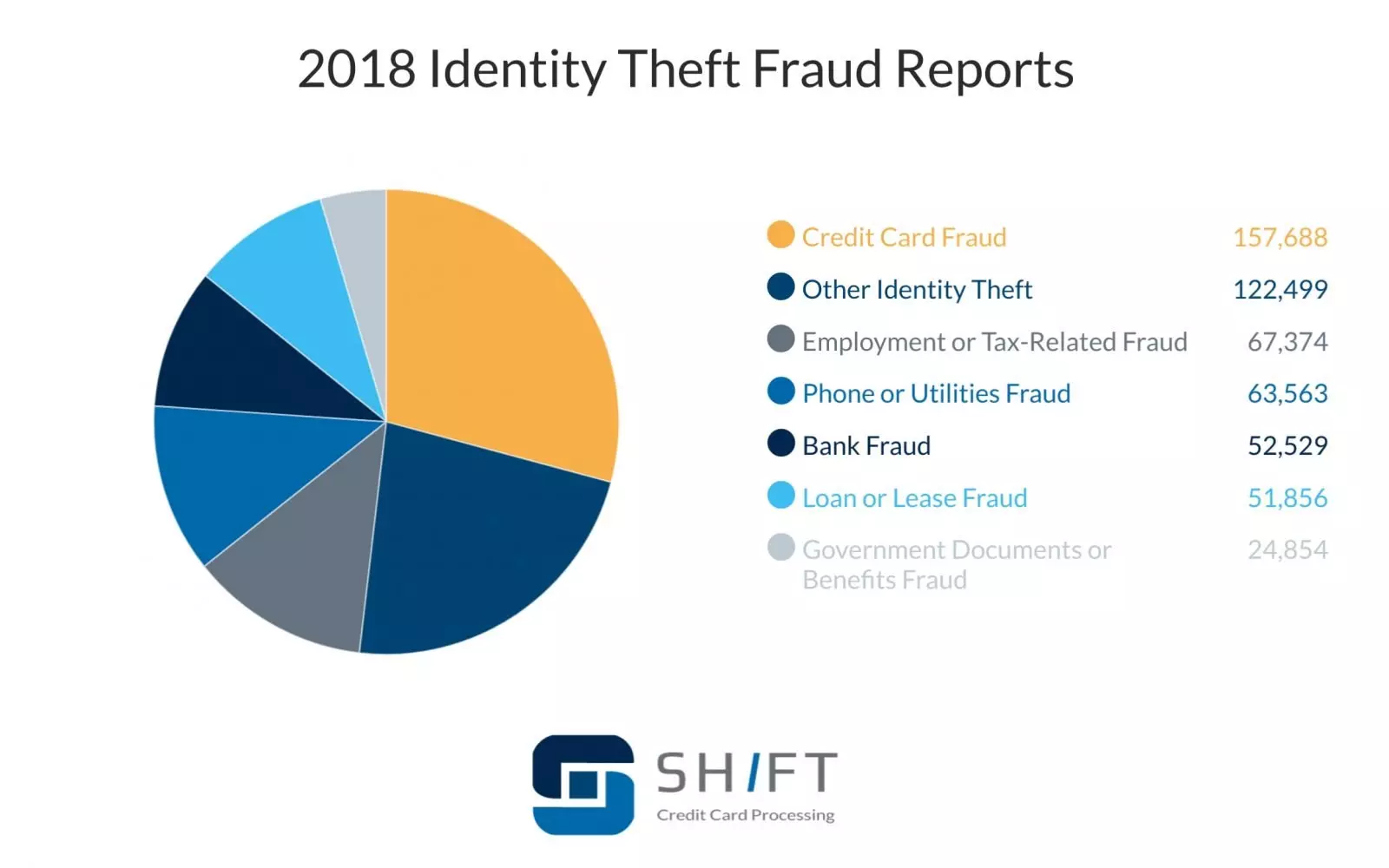

According to McKinsey, damages caused by card fraud could be close to $44 billion by 2025. Based on Federal Trade Commission reports, card fraud topped the list of identity theft reports in 2019 and increased by 72.4% from 2018. Another report presented by The Ascent indicates that among American cardholders, almost 35% were credit card fraud victims. The Business Sector accounted for 46% of data breaches in 2018, including the Marriott International Breach.

There are a few commonly used methods that fraudsters implement when engaging in credit card fraud:

- Fraudulent websites: this is where the user provides his/her card information. With this information, thieves can make fraudulent purchases.

- Credit card skimmer: a small device that scammers can install everywhere you swipe your card (for example, local ATM, gas pump, etc.).

- Access to credit card statements: your statements include the account number and are used to rack up fraudulent charges.

Card fraud causes not only damages to cardholders, but also financial institutions providing transactions by cards. Among money losses, card fraud puts financial companies’ reputation at risk and threatens the loyalty of its customers. People always choose financial institutions with a high level of security. That is why financial institutions and banks need competent and practicable techniques to battle against fraud.

Machine Learning as a Card Fraud Detection Technique

Traditionally, banks and other financial institutions have tried to solve the fraud detection problem using manual procedures. According to some complex criteria, suspicious transactions are taken into account and reviewed manually. However, this approach has not ensured success. It needs an enormous amount of time and can find only prominent fraud activities.

Machine learning algorithms are the ideal solutions for financial institutions in fraud detection. Using customer data, ML algorithms can automate the analysis of customers’ behavioral patterns for quickly identifying any signs of abnormality, and find fraudulent activity in real-time. With high accurate ML models, financial firms can go one step further and prevent fraud, even if the patterns are previously unknown. Overall, firms can reduce financial losses, improve their customer experience, and provide more reliable credit card services.

Fraud detection by machine learning techniques can be grouped into two parts: fraud analysis (misuse detection) and user-behavior analysis (anomaly detection). In the case of first group methods, using historical data transactions are classified as usual and fraudulent. Then there are created classification models that predict the type of new transactions: standard or fraudulent. The most used and valuable methods of model creation are logistic regression, decision trees, and neural networks. The second group takes into account the customer’s behavior and uses unsupervised methodologies. In this case, transactions are classified as fraudulent if they contrast the cardholder’s routine. The logic used here is the following: fraudsters will not behave the same way as the card owner. Hence, every account is analyzed, and based on the results, behavioral models are created. Information used in this analysis contains the number of transactions, the time when they have been conducted, merchant types, etc.

In this modern era, it is significant for financial firms to be one step ahead of fraudsters, and machine learning algorithms are powerful tools to detect and solve credit card fraud problems. Jack Gold, the founder of J. Gold Associates, states that “Most of the major companies in security have already moved to a machine learning system that tries to interpret actions and events and learns from a variety of sources what is safe and what is not.” With this powerful tool, we can work to prevent the frequency of credit card fraud and protect the security and financial privacy of consumers.