COVID-19’s Impact on Fintech

Could we be seeing a global shift in how consumers use technology to interact with their finances?

As weeks in turn become months, there is further reason to believe the current COVID-19 crisis is not a one-off occurrence but a global shift, a before and after in how we work, travel, and live. It’s only expected that most if not all major industries worldwide are being affected; one pertinent to our company is fintech or financial technology.

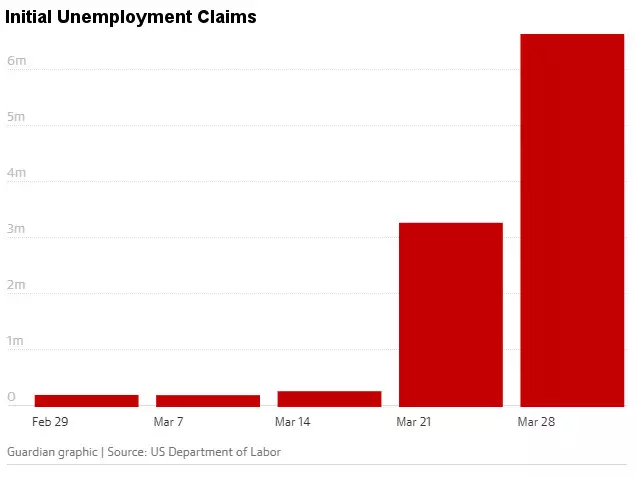

According to Patrick Schueffel, fintech is a new industry within finance applying technology to enhance financial activities. Similarly, a Huffington Post article from the same year defines it as “businesses that leverage new technology to create new and better financial services for both consumers and businesses … [such as] in personal financial management, insurance, payment, asset management, etc.” Fintech is not a monolith despite what its name may suggest. Not unlike the financial industry it symbiotically collaborates with, it encompasses a wide array of organizations, and COVID-19 may not impact all companies falling under the fintech umbrella similarly, if at all. Until we know the impact on specific subindustries within fintech, a better measure of the effect might be the general filing for unemployment benefits. Two weeks ago, 3.3 million people filed for benefits, and this week another 6.65 million, taking the two weeks totaled up to 9.95 million. For comparison, this is more than the last ten months combined.

Interestingly, there is a new circumstance related to COVID-19 and fintech specifically. Treasury Secretary Steve Mnuchin recently elaborated on a provision within the CARES Act, the latest stimulus package being implemented by the United States government to mitigate the effects of the COVID-19 crisis. He mentioned that any fintech lender could take part in the small loan guarantees being provided for small businesses currently impacted. Yet again, the heterogeneity or diversity within fintech is apparent. Not all fintech companies are lenders or have liquid capital readily available to provide loans to others. Perhaps a sizeable percentage of them do. Hence Mnuchin’s mentioning.

An article on Forbes sites research in Europe, suggesting a 72% increase in the use of fintech apps; however, this is rightly attributed to the new lockdown measures being implemented worldwide. Ultimately, we may look back on the COVID-19 crisis years from now as the catalyst to an already modernizing, digitalized, and “remote” world. A hobbled, yet still, working world where industries across the board migrated to an increasingly digital landscape and adapted as best as they could to a 21st-century world where essential commodities and complex financial transactions alike could and will be done with the push of a button.